Technical Analysis on Affirm Holdings Inc. (AFRM)

For Week of November 18th, 2024

View The Updated Trade Plan Below The Video

If you have any questions or suggestions feel free to comment below.

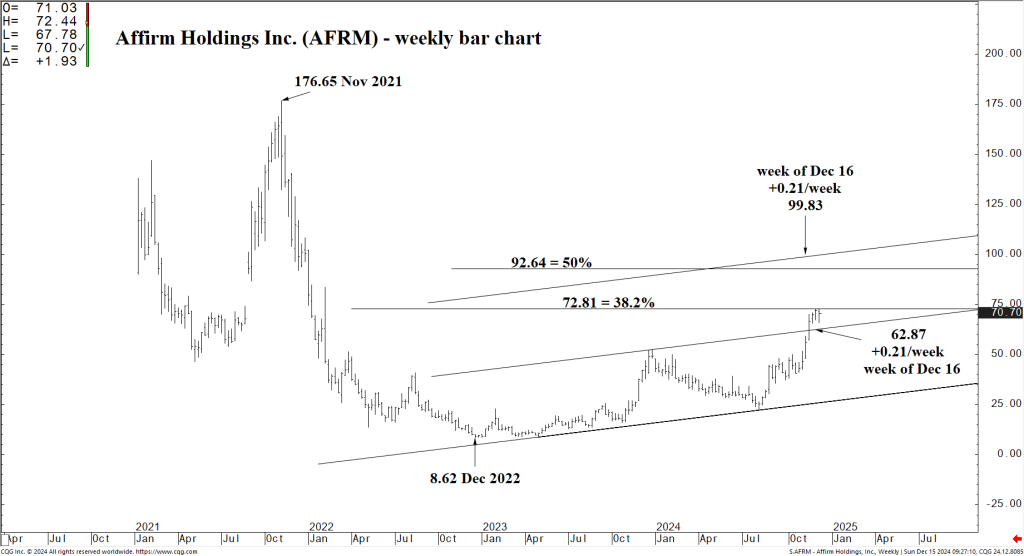

Trade Plan for Affirm Holdings Inc. (AFRM) for week of December 16th.

Trade Plan for Affirm Holdings Inc. (AFRM)

1. Entry Point:

- Buy Signal: AFRM is currently in a buy signal since it closed above the 62.87 channel top by a 1% margin. Enter a long position as AFRM is trading near the $62.87 channel top.

2. Stop Loss:

- Set your stop loss at $60.00.

- Secondary stop loss - If AFRM closes back below the 62.87 channel top on a weekly basis (Friday settlement), it signals potential downside and a need to protect capital. If you do not use the $60.00 stop loss, make sure you exit long positions on a weekly settlement back below 62.87.

3. Target Profit:

- Short-Term Target: $72.81. Reaching this level in the next 2-3 weeks represents a 15% gain and serves as an initial profit-taking point.

- Long-Term Target: $99.83. This target, representing a full channel extension, aligns with a 50% Fibonacci retracement and could be reached in 3-5 months, potentially delivering a 50% gain.

4. Risk Management:

Patience & Discipline: Hold positions until targets are hit, ensuring small losses and letting winners grow. Avoid deviating from the stop loss or target profit to keep emotions in check.

Position Size: Consider position sizing so that a stop loss at $60.00 limits your risk to a manageable level (typically no more than 1-2% of your total capital).

Join 1,000+ Smart Investors Unlocking Big Opportunities

Get exclusive access to premium stock picks, real-time market insights, and powerful updates that keep you ahead. Starting today, claim our latest high-potential stock picks—absolutely free during your 5-day trial.

Ready to uncover the stocks primed for big gains?

Leave A Comment

You must be <a href="https://wickedstocks.com/wp-login.php?redirect_to=https%3A%2F%2Fwickedstocks.com%2F2024%2F11%2F16%2Faffirm-holdings-inc-afrm-free-stock-pick%2F">logged in</a> to post a comment.